Housing Market Update July 2022 Orcutt Real Estate

Housing Market Update July 2022 Orcutt Real Estate

The real estate market has changed! We are seeing a different housing Market right now than what we have experienced in the last 2 years. Longer days on the market is producing more options for the buyers. I’m going to give you recap our Local numbers and then hit on some market highlights.

Santa Maria in June we had a 24% increase in the avg home price, now sitting at $579,385. Days on the market doubled to 22 days average up from only 10 days in 2021.

For Orcutt in June the Average sales price stayed about the same as 2021 at $625,564. Days on the market also stayed about the same at 13 days average.

We are seeing talks all over the internet about the economic slowdown and a looming recession.

So what does that mean in the industry of real estate?

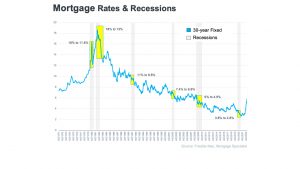

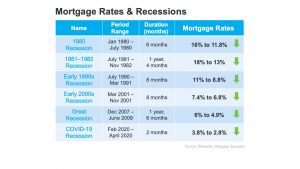

Throughout history during a recessionary period, interest rates go up at the beginning of the recession but in order to come out of a recession, interest rates are lowered to stimulate the economy moving forward. I wanted to share a couple graphs with you to show what happens during recessionary times.

This graph is going way back to the early 70’s. So the outline in the blue is the 30 year fixed interest rate. The boxes in yellow are the recessionary periods. This information showed in a table format is also helpful to show what has happed and how long it happened. This shows the starting interest rate and then what they fell to. One thing that every recession has in common is that mortgage rates fell.

Now – no one has a crystal ball – but for the past 5 recessions mortgage rates have fallen an average of 1.8% from the peak to the trough.

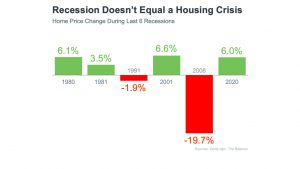

We have said it before… recession does not mean housing crisis. This shows that in the last 6 recessions – 4 of them, homes appreciated.

So what does that mean for you if your looking to buy or sell a property? We are seeing some key trends with inventory and and offers received. We are seeing less offers received on properties and longer days on the housing market.

So a quote from Mark Fleming states it perfectly

“There has been a pickup in the inventory that we’ve seen recently, but it’s not from a big increase in new listings, but rather a slowdown in the pace of sales. And remember, that month supply measures the inventory of sales relative to the pace of sales”

Basically same inventory, fewer sales means more months supply.

A balanced housing market is 6 months supply of inventory, which we are currently not at – but moving in a better direction. If you are a buyer looking to purchase – you now will have more options.

We still have far more buyers than sellers so that is continuing to put an upward pressure on prices, but more options are continuing to come onto the market.

Now last thing to touch on – is it the right time to buy? There are some scary headlines out there.

Yes home prices are decelerating but that doesn’t mean depreciating home prices.

Decelerating home prices means there not as much appreciation as what we’ve seen in the past – which is good because the 20-21% price appreciation was not sustainable. So that is slowing down to where we were at pre-pandemic. Forecasters are still seeing a 8.5% appreciation.

To bullet point all this information… What drives home prices? Supply and demand and interest rates affect that. When Interest rates go up, fewer buyers can afford homes. Exactly what we are seeing right now. Demand is going down and prices are softening from the crazy world the we have seen.

So, I hope this all gives you something to think about. I’m always available to offer a free price opinion if you’d like to know what your house is worth because The value has definitely changed over the past year! And if your looking to purchase – lets set up an appointment to chat about the market and your lending options.

Thanks for watching and I hope your having a wonderful summer. Any questions – send me a message – always here to help….